How to Calculate and Understand Your Company’s Valuation on Your Cap Table

Cap tables, short for capitalization tables, are essential financial tools for startups and early-stage companies. A cap table is a document that shows the ownership structure of a company, including equity and debt, and outlines who owns what percentage of the company.

In this article, we’ll explore the importance of cap tables, how they work, and why they’re crucial for both companies and investors.

The Importance of Cap Tables

A cap table is crucial for understanding the ownership structure of a company. It outlines who owns what percentage of the company Cor Opera and how much each owner has invested in the business. This information is essential for making informed decisions about the company’s future.

A cap table can also help startups and early-stage companies avoid potential legal and financial issues down the road. By keeping track of ownership changes and equity distributions, companies can ensure they are complying with legal requirements and avoiding conflicts with investors.

For investors, a cap table provides critical information on the company’s ownership structure and potential return on investment. It helps investors understand the company’s valuation and how their investment will impact the company’s future growth and success.

How Cap Tables Work

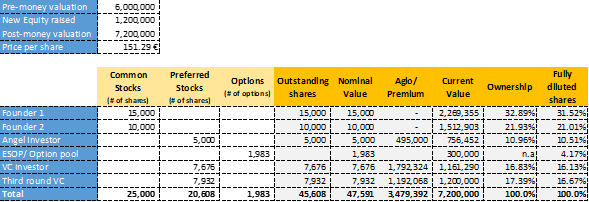

Cap tables typically include four main sections: shareholders, securities, ownership percentages, and investment details.

The shareholders section lists all the company’s shareholders and their ownership percentages. This section includes information on founders, employees, and investors and shows how much each person or entity owns in the company.

The securities section outlines the various types of securities issued by the company, including common stock, preferred stock, and debt. This section also includes details on the rights and preferences of each security type.

The ownership percentages section shows the percentage of the company owned by each shareholder, including any dilution caused by new investments or equity distributions.

The investment details section provides information on the amount of investment each shareholder has made in the company, including the type of security they hold and the amount they paid for it.

Why Cap Tables are Crucial for Companies

Cap tables are crucial for companies, especially startups and early-stage companies, because they help ensure that the company is complying with legal requirements and avoiding conflicts with investors.

By keeping track of ownership changes and equity distributions, companies can avoid issues with dilution and ensure that all shareholders are treated fairly. A cap table can also help companies make informed decisions about future fundraising and financing options.

In addition to compliance and decision-making, cap tables can also help companies attract investors. By providing investors with a clear and accurate picture of the company’s ownership structure and potential return on investment, cap tables can help build trust and confidence in the company’s leadership and strategy.

Why Cap Tables are Crucial for Investors

Cap tables are equally important for investors, as they provide critical information on the company’s ownership structure and potential return on investment.

By understanding the ownership structure of the company, investors can make informed decisions about the company’s future growth and success. They can also use the cap table to calculate their potential return on investment and estimate the value of their equity stake.

Cap tables can also help investors avoid potential conflicts with other shareholders. By understanding the rights and preferences of each security type, investors can make informed decisions about their investments and avoid dilution caused by new investments or equity distributions.

Conclusion

In summary, cap tables are essential financial tools for startups and early-stage companies. They provide critical information on the ownership structure of the company, including equity and debt, and help ensure that companies are complying with legal requirements and avoiding conflicts with investors.

For investors, cap tables provide valuable insights into the company’s ownership structure and potential return on investment. They help investors make informed decisions about their investments and avoid potential conflicts with other shareholders.

Overall, cap table are crucial for both companies and investors and should be considered an essential part of any startup or early-stage company’s financial toolkit.